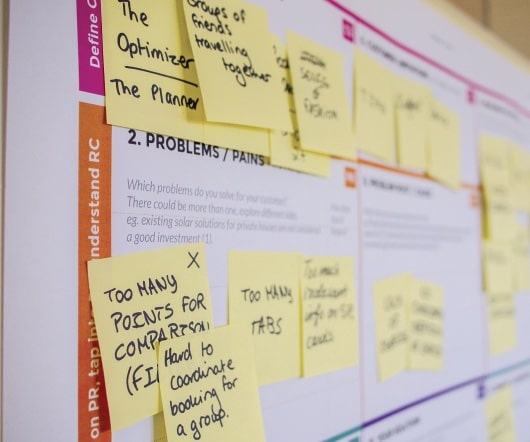

Orchestrating the Switch from AI Agents to Human Interaction – When and Why It Matters in CX

eglobalis

MARCH 18, 2025

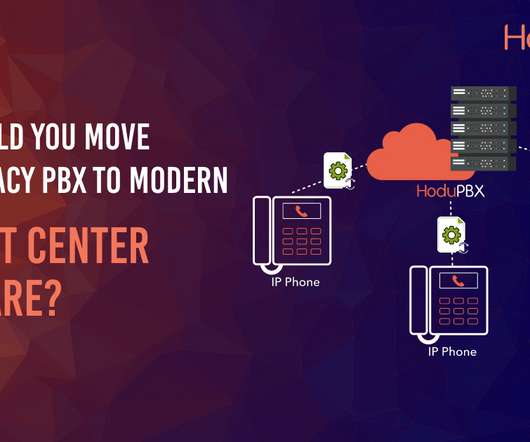

In today’s rapidly evolving AI Agent experience landscape, Artificial Intelligence (AI) has become integral to enhancing customer service and experience efficiency and responsiveness. Regulatory and Compliance Issues Certain industries, such as finance and healthcare, involve strict regulatory requirements.

Let's personalize your content