Stuck in an Outdated CX Framework? Here’s Why You’re Missing Out on Real Results

eglobalis

NOVEMBER 3, 2024

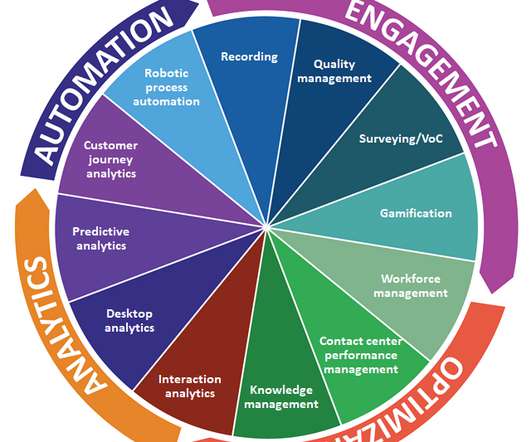

Advanced data analysis, such as behavioural analytics and sentiment analysis, also provides a quantitative view of client preferences and emotional responses, helping to anticipate issues before they arise and to personalize interactions at every touchpoint.

Let's personalize your content